Digital Public Infrastructure (DPI) is a transformational approach that has the potential to deliver population-scale economic and social progress, and ensure environmental equity. Using digital transformation, open data, and open APIs, DPI promises responsive governments, resilient communities, and an improved quality of life.

The Digital India Stack has been the key enabler of India’s digital economy. It has patched leaks in delivering welfare benefits, brought hundreds of millions into the formal economy, empowered citizens, propelled small businesses, and promoted social and financial equity.

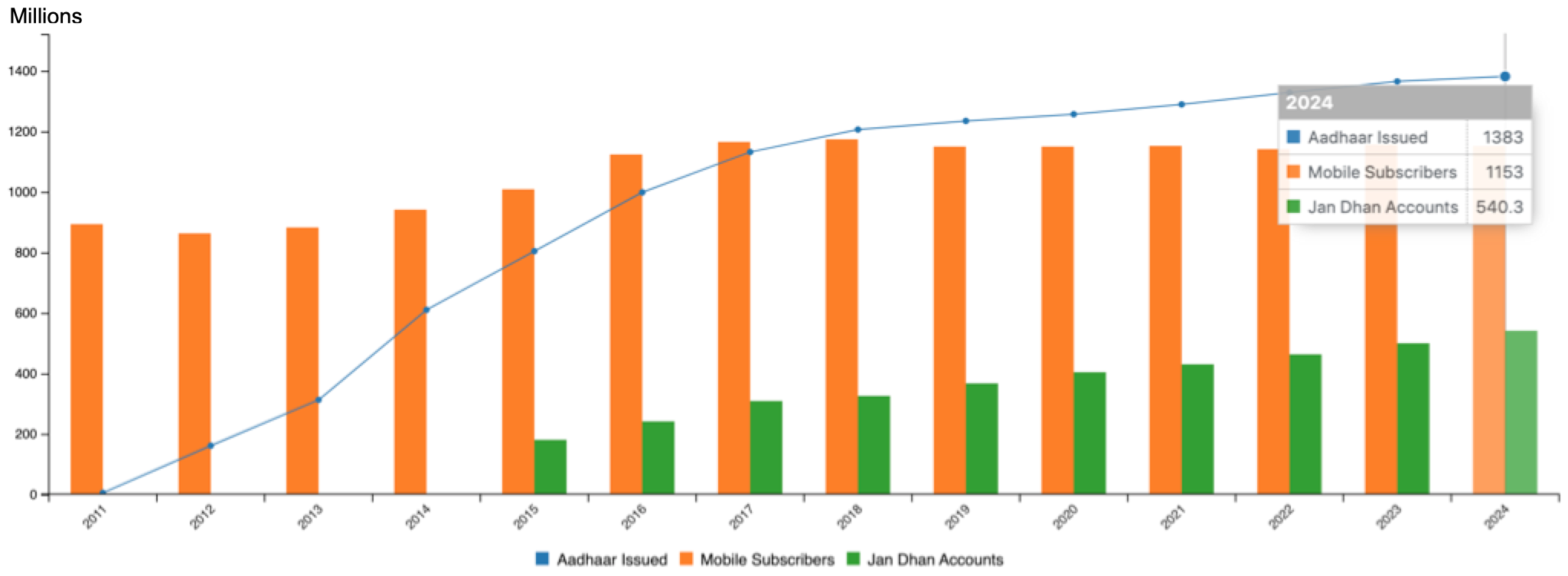

The foundational start for the Digital India Stack was provided by a biometric digital ID called Aadhaar (meaning foundation in Hindi). About 1.4 billion Aadhaar IDs have been issued, providing the digital identity and authentication service for the Digital India Stack. There is no denying that DPI has been a spectacular success in India. Countries of the Global South are keen to replicate India’s success with poverty alleviation and its accelerated progress on human development indexes. What lessons can be learned from the Digital India story?

What path should countries take to ensure similar outcomes? Should countries start with a nationwide Digital Identity platform and build digital services around it? What constitutes public ‘digital infrastructure’? How do we measure success? How do we use India as a playbook for the Global South?

To answer these questions, it is necessary to take a closer look at India’s digital infrastructure rollout. The general assumption is that the Digital Identity solution (Aadhaar) was foundational to India’s digital transformation and improved social infrastructure. While Aadhaar was key to providing an identity to millions without an official photo ID, it was another government program, the Jan Dhan Yojana (Public Finance Scheme), that bridged the digital divide by first bridging the physical divide.

A Victim of Its Own Success

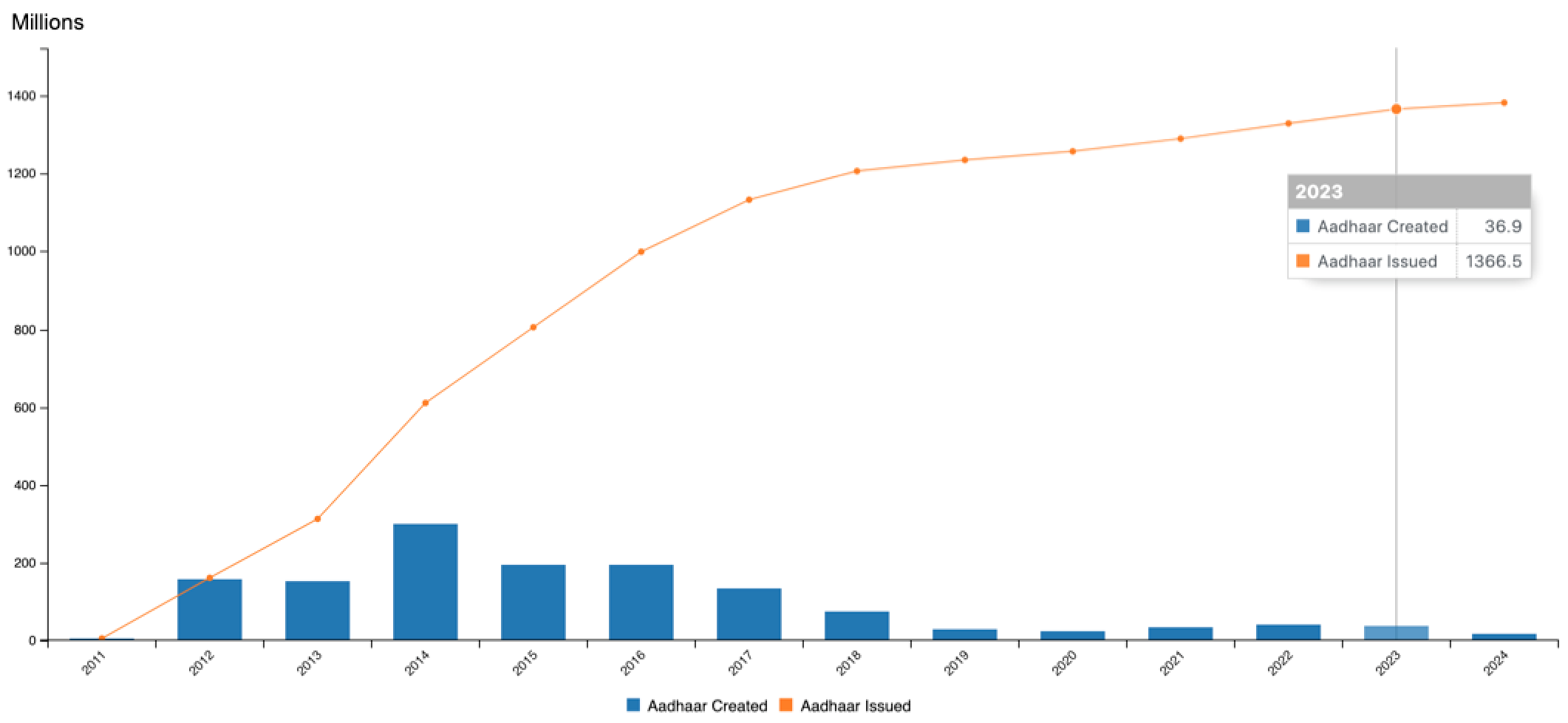

The first Aadhaar ID was issued in September 2010. By the end of 2013, over 300 million Aadhaar IDs had been issued and by the end of 2016, close to a billion. Using biometrics and digital APIs, identity could be verified instantly, bringing down the cost of authentication from $12 to $0.06.

Aadhaar numbers generated by year (Data: UIDAI; Visualization: Hawkai Data)

Aadhaar numbers generated by year (Data: UIDAI; Visualization: Hawkai Data)

The growing use of Aadhaar led to several petitions being filed in the Supreme Court challenging its use citing privacy concerns. Concerns were also raised about its use being mandatory for receiving benefits. Aadhaar scanners breaking down in the field and patchy 3G/4G wireless connections prevented many from receiving the benefits that they were entitled to. In 2018, the Supreme Court ruled that Aadhaar could not be made mandatory to open bank accounts, get mobile phone connections, or receive social security benefits.

The rush to assign IDs to every resident also led to unintended data errors. When an individual’s date of birth could not be confirmed, it defaulted to January 1 and an approximate year of birth was recorded. It was reported that in some areas, most residents had January 1 as their birth date on the Aadhaar ID card. Concerned with these data errors, the Supreme Court in further rulings disallowed Aadhaar as an authoritative proof of address or date of birth.

Aadhaar did bring positive change. It gave an identity to millions who were invisible to the state. Aadhaar biometrics allowed the tracking of thousands of missing children and many others. Aadhaar digital APIs for verifying identity significantly brought down customer acquisition costs. It enabled telecom operator Reliance Jio to acquire over 100 million new customers in less than six months.

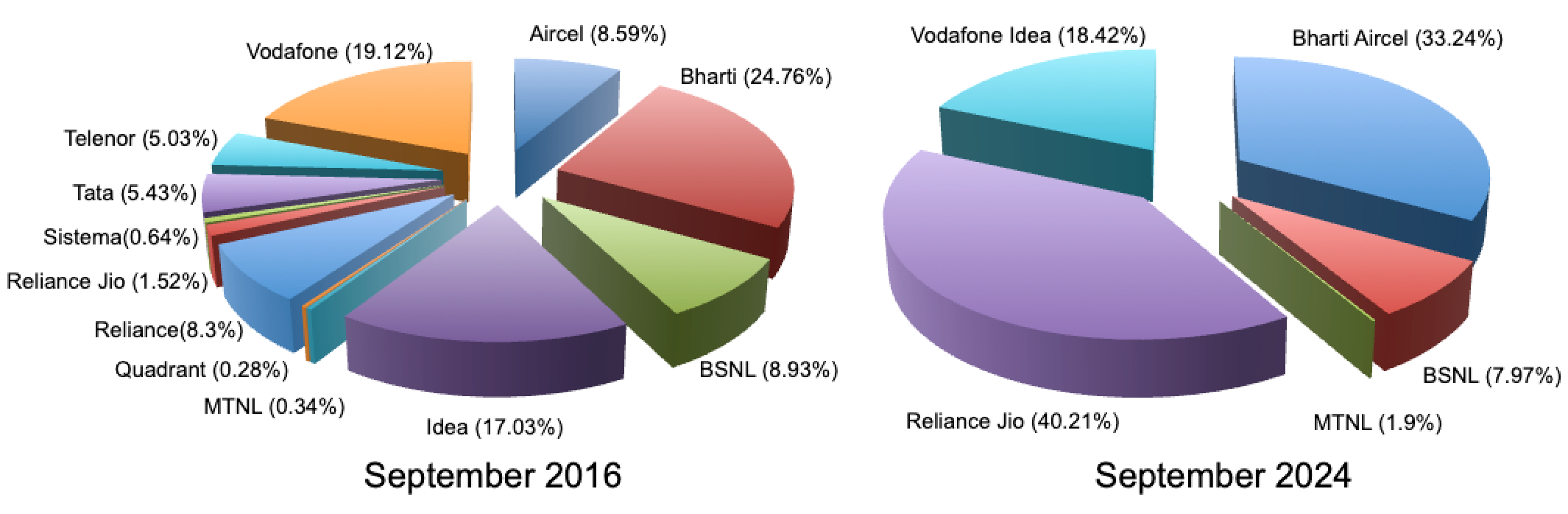

Share of Wireless subscribers by Telco (Data: TRAI; Visualization: Hawkai Data)

Share of Wireless subscribers by Telco (Data: TRAI; Visualization: Hawkai Data)

Reliance Jio launched in September 2016 and within a month added over 15 million subscribers to take 1.52% market share. Today, it is the largest mobile operator in India with over 463 million wireless subscribers, with over 40% market share.

The ID did help millions get access to services like health, education, and banks. The problem was, in the poorer regions and rural areas, health, education, and banking facilities were non-existent. Having a digital ID did not help when the brick and mortar facilities delivering these services were not available or accessible.

In 2014, Prime Minister Narendra Modi launched the National Mission for Financial Inclusion called the Jan Dhan Yojana. Instead of people going to the banks, the banks came to the people. With the banks came electricity to power the equipment and homes, clean water and sanitation, roads to transport goods, access to services like health and education, and schools to skill youth to access and operate the digital future.

Doorstep Banking

The Jan Dhan Yojana was a financial inclusion program that provided free financial services to the unbanked. The program included a range of services including a no-fee interest-paying bank account, a no-fee debit card, overdraft facility, no-cost accidental insurance, low-interest loans, and direct deposit of pensions and other social security benefits.

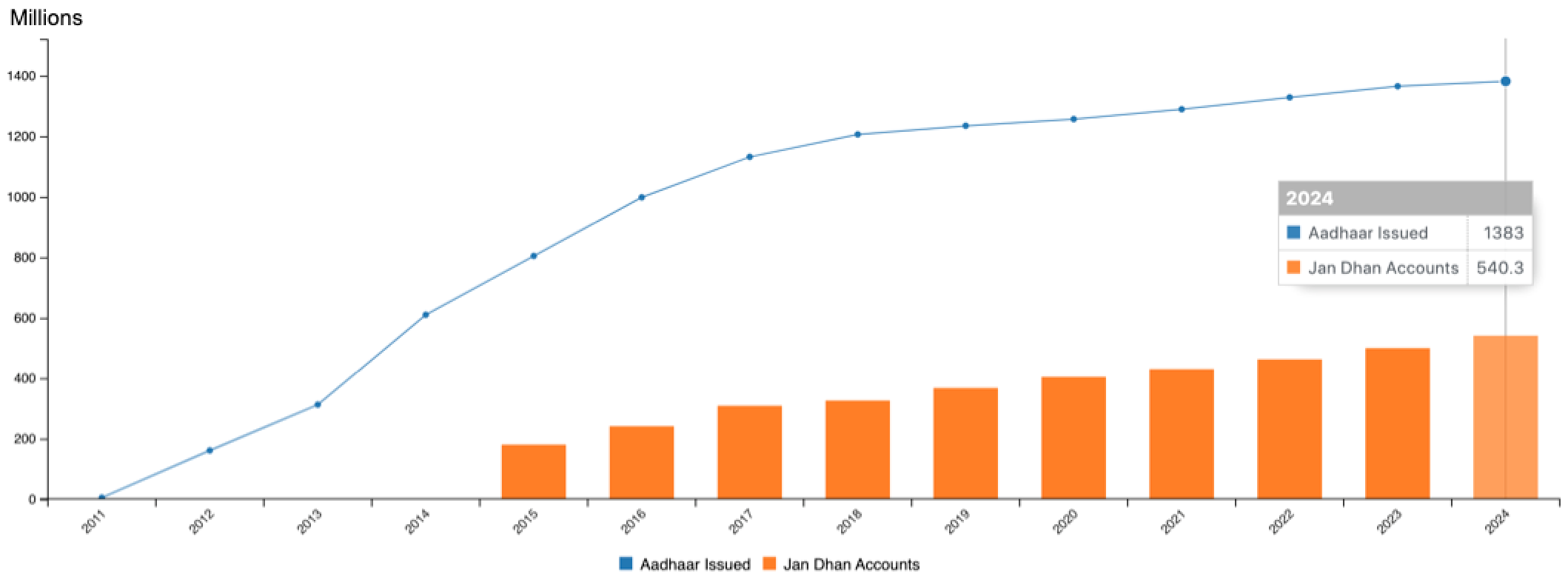

The availability of Aadhaar IDs accelerated the opening of these bank accounts. Within three years of its launch, banks had acquired over a quarter of a billion new customers. Currently, over half a billion Jan Dhan accounts have been created between Public Sector, Private Sector, and Regional Rural Banks.

Total Jan Dhan accounts by year (Data: PMJDY; Visualization: Hawkai Data)

Total Jan Dhan accounts by year (Data: PMJDY; Visualization: Hawkai Data)

The availability of bank accounts allowed the government to directly deposit social security benefits, pensions, and other beneficiary schemes into these accounts. Aadhaar-linked data was used to find and eliminate tens of millions of duplicate, fake, and ineligible beneficiaries. Removing fraud and leaks in direct benefit transfers has helped the government save over $40 billion.

Banks also started skilling local youth to act as last-mile extensions of the bank. The Bank Sakhi program (Female Friends of the Bank) trains local women to go house-to-house and facilitate banking transactions like deposits and withdrawals, and accessing remittances, pensions, and other direct-transfer benefits. The goal of the Jan Dhan Yojana scheme is to have a banking facility within 5 kilometers of any household.

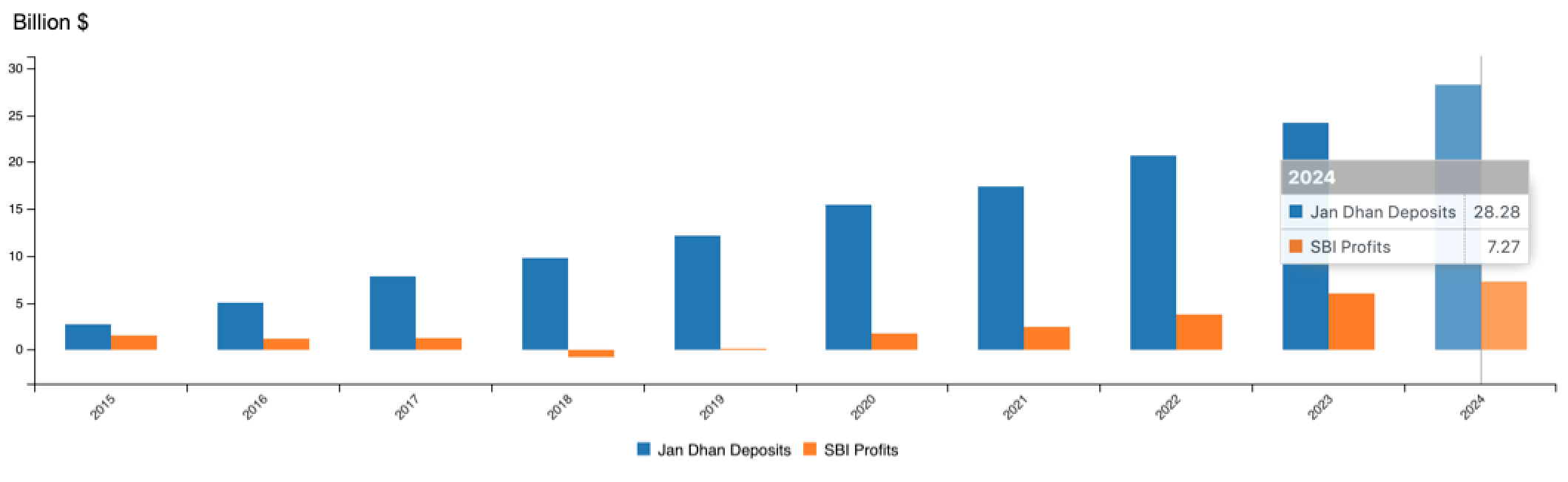

Public Sector banks like the State Bank of India (SBI) took the lead in establishing these remote banking outposts in underserved areas. Deposits in these accounts have grown from around $2 billion in 2015 to over $28 billion. This growth in customers, bank accounts, and deposits was not the result of any shiny new fintech product but the result of old-fashioned good customer support that prioritized genuine human engagement.

SBI profits have grown with Jan Dhan account deposits (Data: PMJDY, SBI; Visualization: Hawkai Data)

SBI profits have grown with Jan Dhan account deposits (Data: PMJDY, SBI; Visualization: Hawkai Data)

While Jan Dhan deposits continue to rise, so have bank profits. SBI, which has the largest number of these accounts, announced a record $7.2 billion in profit in the 2023-2024 financial year. Financial inclusion empowers individuals, boosts businesses, fosters growth, alleviates poverty, and promotes equity. It can also be extremely profitable.

JAM Trinity (Jan Dhan, Aadhaar, Mobile)

The availability of Aadhaar and low data rates boosted mobile phone ownership. Today, over 95% of households have a mobile phone. The Jan Dhan Yojana, similarly, boosted the share of households owning a bank account to over 99%.

JAM trinity has reached saturation levels (Data: UIDAI, TRAI, PMJDY; Visualization: Hawkai Data)

JAM trinity has reached saturation levels (Data: UIDAI, TRAI, PMJDY; Visualization: Hawkai Data)

Linking a bank account with Aadhaar allowed direct benefits transfers. Connecting Aadhaar, bank accounts, and mobile phones enabled the Universal Payments Interface (UPI), where money could now be sent not just from the government to the people, but people to people, and people to businesses. UPI’s QR code based merchant payment did not require powered POS terminals or a private secure data network. This enabled hundreds of millions of small businesses and service providers to accept electronic payments directly into their linked bank accounts, significantly reducing the need for cash and paper receipts.

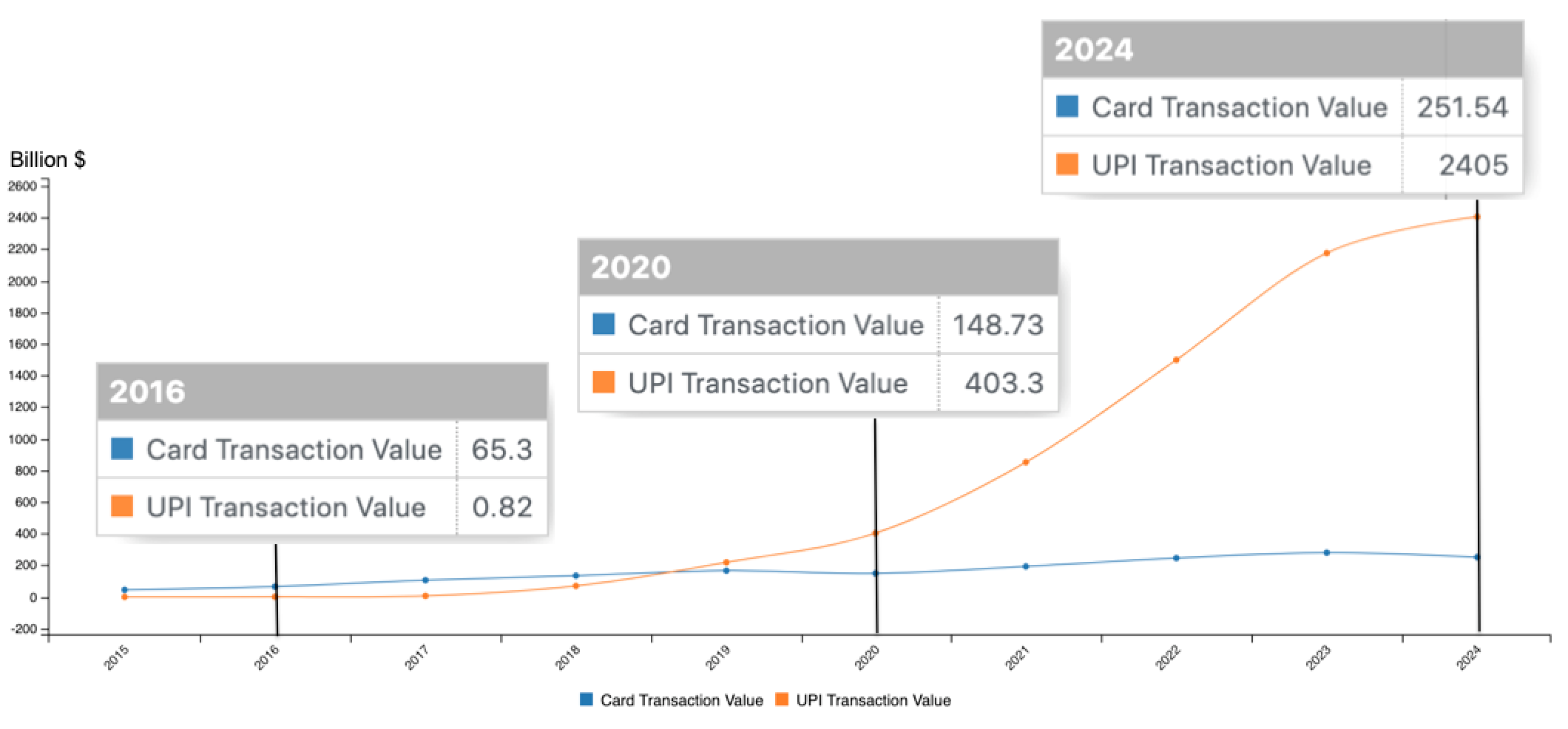

Growth in Digital Payments – Cards vs UPI (Data: RBI, NPCI; Visualization: Hawkai Data)

Growth in Digital Payments – Cards vs UPI (Data: RBI, NPCI; Visualization: Hawkai Data)

UPI was launched in 2016. In 2016, credit and debit cards were still the primary form of digital payments, with over $65 billion transacted using cards. Within three years of launch, UPI had overtaken cards in total transaction value, breaching $1 trillion by 2022, and $2.5 trillion by the end of 2024. The total payments using UPI have grown exponentially, while growth in card payments has flatlined, with UPI transaction value almost 10x that of card transactions.

Over 800 billion credit and debit card transactions happen every year. This translates to an electricity consumption of 1.18 terrawatt-hours annually. The penetration of POS terminals is limited in large parts of the Global South. As marketplace transactions in these parts become more digital, the volume of credit/debit transactions will significantly add to the carbon footprint. UPI is a greener and more sustainable option for digital payments. UPI will create a more sustainable and inclusive digital economy, allow no-cash marketplaces to flourish, and enable the transition to a formal economy.

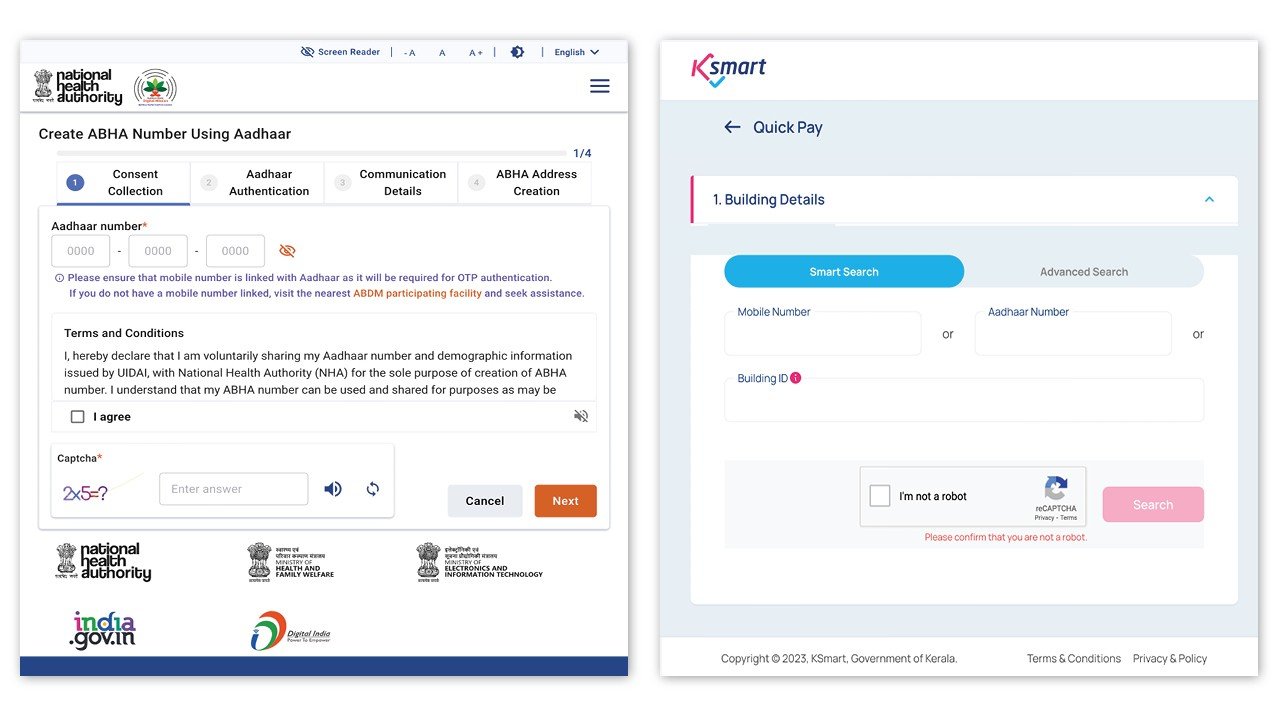

The 2018 Supreme Court judgment and concerns around privacy issues, limited the use of biometric-based authentication. Linking the Aadhaar number with a mobile phone allowed mobile authentication using an OTP (One-Time Password).

The Aadhaar Number based authentication simplifies the process of registering and signing into a service with a consistent, simple, and seamless user experience. Enter your Aadhaar number, receive an OTP on your linked phone, enter the OTP and you are done. The service can retrieve any other information like an address or photo, as required using Aadhaar APIs. OTP authentication also eliminates the complexity of managing passwords for signing into different services.

Signing for a Health Card and paying Property Tax use Aadhaar based OTP authentication

Signing for a Health Card and paying Property Tax use Aadhaar based OTP authentication

Public digital services will be adopted if the customer experience matches customer expectations. Aadhaar number based OTP authentication allows for a seamless customer experience across any public digital service.

Linking Aadhaar with a Mobile Phone registry, enabled OTP authentication. Linking Aadhaar with a bank account registry, enabled Direct Benefits Transfer. Linking a bank account to a phone registry enabled UPI.

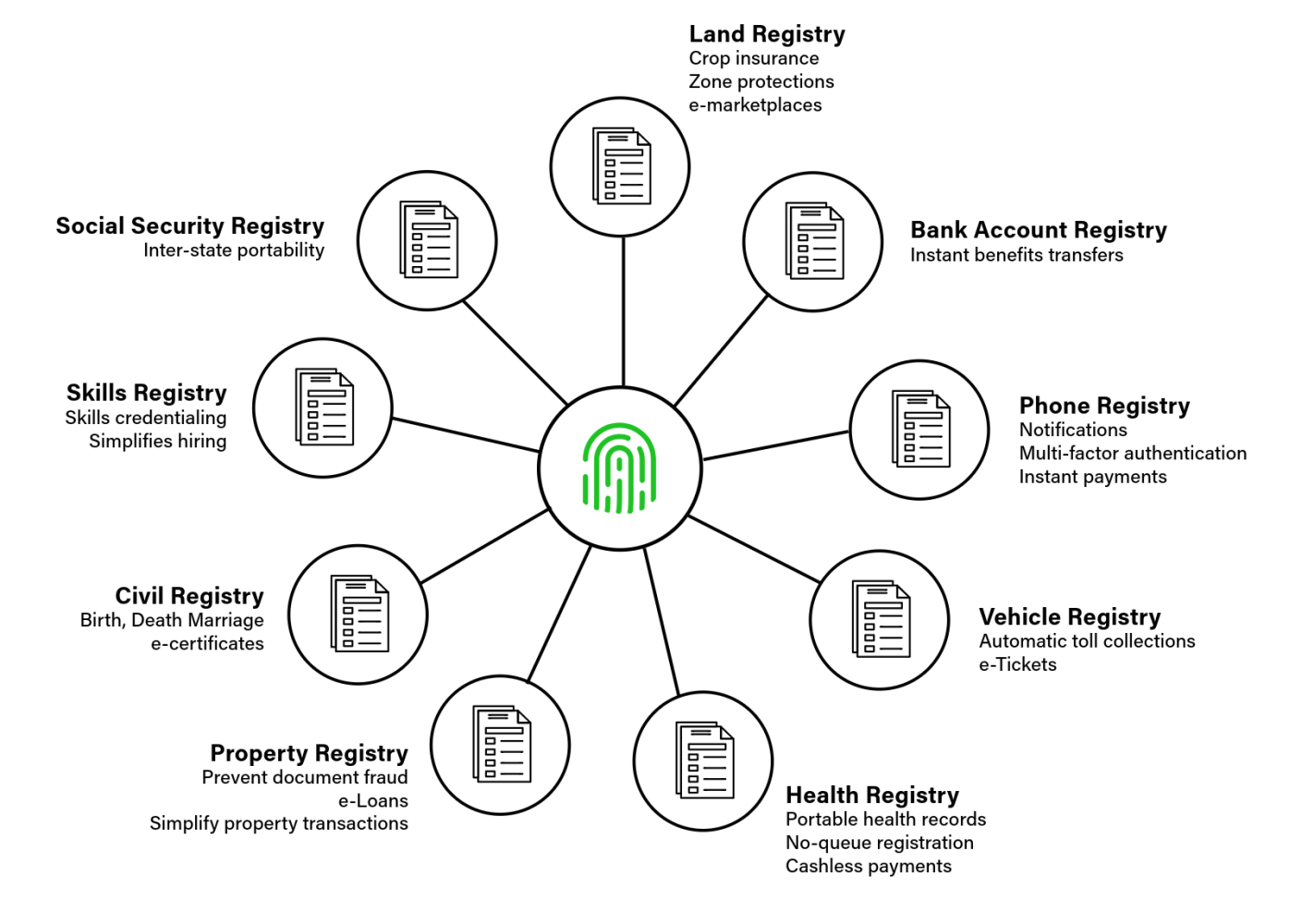

Digital services need data. A registry provides the data. An official registry is the single source of truth for the data. Linking identity with a registry creates a service. As more physical assets are digitized, more digital registries will get created and linking the registry to identity will create new digital public services.

Linking Identity with a Registry enables a Digital Public Service

Linking Identity with a Registry enables a Digital Public Service

When data is open and available, and digital access is inclusive, these digital public services will make governments responsive, communities resilient, improve the lives of citizens, create profitable businesses, and sustainably grow the economy.

The DPI Playbook

Aadhaar advanced data equity. The Jan Dhan Yojana advanced physical equity. The JAM trinity is now advancing digital equity. If there is one lesson from India’s DPI rollout, it is this, that for DPI success, data equity must precede physical equity, and physical equity must precede digital equity.

India’s last census was done in 2010. The Aadhaar data filled in the gaps. Aadhaar was about identity, but more about data. Aadhaar data was key to identifying duplicate, fake, and ineligible beneficiaries. It also provides last-mile accurate data and can provide information about geographical distribution of population, age and gender demographics. Additional mining of data can reveal insights into household sizes, availability of housing, and identify areas with the most underserved populations (one way for visualizing underserved areas is by clustering areas with high numbers with January 1 birthdates, or unconfirmed date of birth).

The Jan Dhan Yojana was successful because good data was available; data that informed where the underserved populations were, where the infrastructure gaps were, and what investments were needed to address the gaps. Physical equity is ensuring that brick and mortal facilities are available and accessible to all. Physical facilities include schools, hospitals, roads, access to power, water and sanitation, sewage treatment plants, data centers. Physical equity is conditioned on a skilled workforce and institutional capacity building capabilities.

The JAM trinity was foundational to advancing digital equity. Once digital access is inclusive, and as physical assets get digitized and made available as public registries, public digital services built on these registries will bridge the digital divide. As more residents migrate to these digital services, in-person visits to offices will go down, queues and processing times will reduce, traffic and pollution will go down, and citizen perception will go up. It will have a multiplier effect on the operational effectiveness of any city or regional initiative and improve the quality of life for all residents.

Economic growth and attaining UN SDG targets is not an inevitability. It is the outcome of sound government policies. Policies have multi-year gestation periods before outcomes are realized. We have six more years to meet the SDG 2030 targets. DPI will provide operational efficiencies, advance financial inclusion, expand digital access, and accelerate the achievement of SDGs.

We have the learnings that have moved a country the size and scale of India to get on track to meet its human development indexes. We have the second-mover advantage of hindsight. We have the playbook. The stage is set. The time to act is now.

Further Reading

On Data Equity

Read our article, On Data – Poverty, Quality, and Fragmentation at https://hawkai.net/on-data-poverty-quality-and-fragmentation/

On Physical Equity

Read our article, Achieving SDGs – An Actionable Framework at https://hawkai.net/achieving-sdgs-an-actionable-framework/

On Digital Equity

Watch our video at https://hawkai.net/digital-public-infrastructure/

Data Sources

Aadhaar – UIDAI data is available at https://uidai.gov.in/en/media-resources/uidai-documents/annual-reports.html

Jan Dhan Yojana – PMJDY data is available at https://pmjdy.gov.in/statewise-statistics

Reserve Bank of India – RBI data is available at https://www.rbi.org.in/scripts/ATMView.aspx

State Bank of India – SBI data is available at https://bank.sbi/corporate/AR2223/financial-legacy.html

Telecom Regulatory Authority of India – TRAI data is available at https://www.trai.gov.in/release-publication/reports/telecom-subscriptions-reports

Universal Payments Interface – NPCI data is available at https://www.npci.org.in/statistics

Notes

- India’s financial year runs from April 1 to March 31 of the following year. SBI’s 2024 profits are for the financial year ending March 31, 2024.

- UPI and credit/debit card transaction value reported for 2024 only include data from January 2024 – October 2024.

- All values reported in USD are at constant currency assuming $1 = ₹84.

- National Health Authority’s Digital Public Service for creating an Ayushman Bharat Health Card is at https://abha.abdm.gov.in/abha/v3/register

- Kerala State’s Digital Public Service for paying property tax is at https://ksmart.lsgkerala.gov.in/ui/property-tax/quick-pay-tax/citizen

- UIDAI Press Notes (Dated: October 27, 2017) –

As per UIDAI policy, in order to allow every resident to enrol for Aadhaar, the date of birth is recorded in three manners. First is the verified date of birth in case resident provides supporting proof of date of birth. Second is the declared date of birth in case resident is able to declare his date of birth with no supporting document. Third, in cases of residents who are only able to give their age, 1st January of that year is taken as per the age given by the resident as date of birth by default for the purpose of enrolment.

It is further, clarified that at later stage if the resident is able to provide supporting document for date of birth, he can update his date of birth in Aadhaar by visiting any Aadhaar enrolment centre or online.

Hawkai Data provides a Customer eXperience Platform (CXP) to quickly prototype, operationalize, and scale applications and services. Start your digital transformation today and create new business and customer experiences using Hawkai Data CXP.

If you have any questions, talk to us at info@hawkai.net, or follow us on LinkedIn at https://www.linkedin.com/company/hawkai-data/, or connect with us at https://hawkai.net.